The Roman currency of the time was know as the Denarious, and it was introcued in 211 BC. This was a 100% silver coin and it held its value all the way up to 64 AD when the debasement of the currency started. In 64 AD the Roman government began to debase their currency, slowly substituing silver for nickel which resulted in the discolouration of the coins.

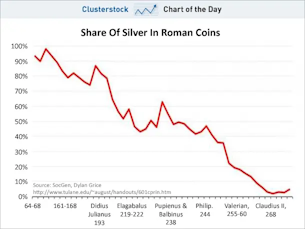

As the Roman Empire continued into its demise and inevtible collapse, so the currency was continually debased with ever more quanties of nickel. The chart below shows the silver content of the Denarious coins all the way up to the end of the Roman Empire in 268 AD. The result of the debasement resulted in a larger money supply, but the money was worth less. This results in higher inflation as time goes on. This can be seen that a typical soldier was paid 300% more in the latter years of the Roman Empire compared to the earlier years.

It look 204 years for the silver content to be completely eradicated from the Denarious.

As the coins were debased so the colouration of the coins also changed. This result in the populous hoarding the coins with a higher silver content and spending the coins with the lower silver content. This is known as Gresham's law, where with a simplistic explanation, explains that bad money drives out good money. Good money is hoarded and bad money is spent.

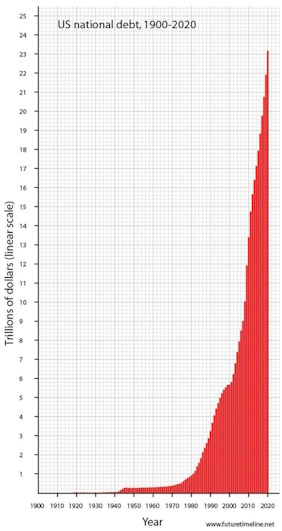

The same thing is happening with the U.S. dollar at the moment, as the U.S. Government has printed trillions of dollars in recent years. This increase in money supply means that there is more money chasing the same amount of goods and services which causes prices to rise, commonly known as inflation. The U.S. Government is borroring roughly $1trn a year in order to fund their bloated government, this increased debt is also increasing the money supply, which flows into the rest of the economy as the money is spent, also contributing to inflation.

The monetary unit of the Roman Empire empire took over 200 years to completely collapse. How long this takes for the U.S. Dollar to follow the path of the Denarious is anyone's guess? Given the speed of technology today, and the extremely free flowing ability of capital, it seems like this will be a lot sooner than expected.

This is why Bitcoin has every chance of becoming the world's next global reserve currency. It's supply is limited to 21m units (each unit divisble by 100m times). Sound money, means a sound economy, and bitcoin promises all of these characteristics.